Here’s a question that should strike close to home. Professional investors like to quote this mantra to anyone who will listen. “Fail fast,” they say. But what if you believe so strongly in your budding enterprise that this seems to be the most ill-advised directive you’ve ever heard?

So here are some rules that might make it clearer for you and for those who so easily quote the mantra.

Rules to consider as tests of early success.

With the first round of funding, there should be agreed-upon milestones to be achieved. If  they are not achieved within the expected time, the reasons must be analyzed by you and by your board and acted upon to avoid loss of capital beyond plan or expectation.

they are not achieved within the expected time, the reasons must be analyzed by you and by your board and acted upon to avoid loss of capital beyond plan or expectation.

If you discover and become convinced that your vision is flawed, or the product impossible to create within cost and time expectations, or the demand impossible to quantify, or revenues never close to plan, then it would certainly be time to rethink the plan and product.

Could you pivot to save the company?

Could you and your team pivot if given the time and runway to do that? Would that restart the clock, putting even more pressure upon you to perform? Your investors know that an excellent management team is perhaps the greatest asset for any company – because it is just this team that has historically been able to make a drastic alteration of the plan, ultimately making a failing vision into a wildly successful one.

[Email readers, continue here…] But if neither great management nor your vision for the product shows real signs of success in the market, then it may surely be time to listen to the investors and perhaps the board. Fail fast! Reduce further expenditures of remaining capital and protect the assets purchased with the original investment.

A personal story of failing fast

My favorite story of a fast failure was of a technology incubator started in the year 2000 with optimistic money from several angel investors, including me. Within a month after the tech crash, the founder of the incubator decided that it made no sense to incubate companies that were not likely to receive new investments soon following incubation in the winter-of-cash that followed the tech crash. He volunteered to close the incubator and he returned 96% of our investments to all of us angel investors. (That return proved to be the best investment return any of us saw in the several years that followed.)

My favorite story of a fast failure was of a technology incubator started in the year 2000 with optimistic money from several angel investors, including me. Within a month after the tech crash, the founder of the incubator decided that it made no sense to incubate companies that were not likely to receive new investments soon following incubation in the winter-of-cash that followed the tech crash. He volunteered to close the incubator and he returned 96% of our investments to all of us angel investors. (That return proved to be the best investment return any of us saw in the several years that followed.)

Is it the end of your entrepreneurial world to fail quickly?

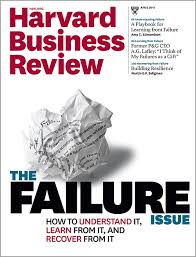

Half of all professionally managed venture capital or angel investments fail. There should be no shame to the entrepreneur in admitting such a failure. Some angel and VC investors will give special credit to those entrepreneurs who have experienced failures when investing in their next effort. The lessons learned are difficult to teach and are great assets in the next effort.

There is little shame and quite a reputation boost in acknowledging a failing plan and “failing fast.”

recognizable when looking back a few years. But even with massive changes, the vision and passion usually don’t diminish in the process of morphing a business plan into a profitable business.

recognizable when looking back a few years. But even with massive changes, the vision and passion usually don’t diminish in the process of morphing a business plan into a profitable business. a top tier Silicon Valley VC firm, whose partner came onto the board. After several months on the board, he spoke up. “I don’t like the niche we’re in. It will never grow enough to make this a valuable company. Forget this niche and turn the battleship. Let’s go after the Fortune 50.” “But that’s walking away from an industry where we are #2, growing nicely and already becoming profitable,” the CEO responded.

a top tier Silicon Valley VC firm, whose partner came onto the board. After several months on the board, he spoke up. “I don’t like the niche we’re in. It will never grow enough to make this a valuable company. Forget this niche and turn the battleship. Let’s go after the Fortune 50.” “But that’s walking away from an industry where we are #2, growing nicely and already becoming profitable,” the CEO responded. surely for the rest of the former board members. As chairman, I should have pushed back. Certainly the CEO-founder had a duty to push back. Another VC from a smaller company should have pushed back. In retrospect, we were intimidated by the first tier VC, and half wanted to believe that he knew something we did not.

surely for the rest of the former board members. As chairman, I should have pushed back. Certainly the CEO-founder had a duty to push back. Another VC from a smaller company should have pushed back. In retrospect, we were intimidated by the first tier VC, and half wanted to believe that he knew something we did not. Eighty percent of all businesses purchased by another company or by a new investor-operator fail to meet the stated expectations of the buyer after one year.

Eighty percent of all businesses purchased by another company or by a new investor-operator fail to meet the stated expectations of the buyer after one year. problems of underestimation of capital, customers who drifted away from the acquired company, key employees who found the new enterprise a culture too different to endure and left, and other difficult-to-plan-for events overwhelm the majority of acquired companies, resulting in less revenue, less profit, and far less growth than forecast during the buyer’s due diligence.

problems of underestimation of capital, customers who drifted away from the acquired company, key employees who found the new enterprise a culture too different to endure and left, and other difficult-to-plan-for events overwhelm the majority of acquired companies, resulting in less revenue, less profit, and far less growth than forecast during the buyer’s due diligence.

companies already serving those beneficiaries. These are your candidates, because they are companies already absorbing much or all the marketing expense necessary to make sales of your invention. They will be more willing to pay a royalty fee if your product gets them to market earlier or is protected by patent to create a barrier to their competition.

companies already serving those beneficiaries. These are your candidates, because they are companies already absorbing much or all the marketing expense necessary to make sales of your invention. They will be more willing to pay a royalty fee if your product gets them to market earlier or is protected by patent to create a barrier to their competition. concerned with your awarding of options to buy stock on advantageous terms. On the opposite side, the investor in your royalty stream (call him the “owner of royalties”) is not concerned with the amount of money spent by the licensee company on staff education, the level of sales commissions paid, and the licensee company’s entertainment policies. Your royalty investor is only concerned with the licensing company’s revenue growth.

concerned with your awarding of options to buy stock on advantageous terms. On the opposite side, the investor in your royalty stream (call him the “owner of royalties”) is not concerned with the amount of money spent by the licensee company on staff education, the level of sales commissions paid, and the licensee company’s entertainment policies. Your royalty investor is only concerned with the licensing company’s revenue growth. against one or more competitors, or which needs a long description to understand, will require considerably more market research, more marketing capital, and entail much more risk than one that follows an existing trend, even if an emerging one.

against one or more competitors, or which needs a long description to understand, will require considerably more market research, more marketing capital, and entail much more risk than one that follows an existing trend, even if an emerging one. analog cell phones. People could not easily or cheaply carry their analog cell phones from city to city, often having no service or having to pay a dollar a minute for roaming service. Our company developed a unique product for hotels that allowed a guest to use a local cell phone provided by the hotel and make calls as if in the room even while traveling through the city, and to remotely receive calls made to the room phone in the hotel.

analog cell phones. People could not easily or cheaply carry their analog cell phones from city to city, often having no service or having to pay a dollar a minute for roaming service. Our company developed a unique product for hotels that allowed a guest to use a local cell phone provided by the hotel and make calls as if in the room even while traveling through the city, and to remotely receive calls made to the room phone in the hotel. succeed. A sense of values that allows for sharing and fairness is not at odds with a ‘type A’ entrepreneur driven for success.

succeed. A sense of values that allows for sharing and fairness is not at odds with a ‘type A’ entrepreneur driven for success. even if your patent application is not opposed or even if the examiner is reasonably receptive to your brilliant idea. The true average cost of a single patent over the twenty years of its legal life is $56,000, when you consider all costs beyond the initial application process. That’s a lot of money for a startup, and it multiplies quickly when your patent is published for comment or opposition or the examiner continues to deny claims.

even if your patent application is not opposed or even if the examiner is reasonably receptive to your brilliant idea. The true average cost of a single patent over the twenty years of its legal life is $56,000, when you consider all costs beyond the initial application process. That’s a lot of money for a startup, and it multiplies quickly when your patent is published for comment or opposition or the examiner continues to deny claims. Then there are the claims that are the core of any patent. Most inventors want to explain the patent fully in its description, paying less attention to the claims. Here’s another blockbusting piece of news. The description is not a legal part of the protection and could even be used to glean more information from you by a competitor than you ever intended. It is the individual claims that form the entire legal basis for protection. And claims must be written with precision, backed by significant research as to other patents which may come close but do not infringe upon each claim. As I have learned form one of my companies and its decade-long fight to enforce a single patent, one word can make the difference between ultimate acceptance by the examiner and then winning a patent infringement suit when that time comes. Whew.

Then there are the claims that are the core of any patent. Most inventors want to explain the patent fully in its description, paying less attention to the claims. Here’s another blockbusting piece of news. The description is not a legal part of the protection and could even be used to glean more information from you by a competitor than you ever intended. It is the individual claims that form the entire legal basis for protection. And claims must be written with precision, backed by significant research as to other patents which may come close but do not infringe upon each claim. As I have learned form one of my companies and its decade-long fight to enforce a single patent, one word can make the difference between ultimate acceptance by the examiner and then winning a patent infringement suit when that time comes. Whew. decisions about finding a company name, where to locate the company, whether to lease an office or start from home, how to engage talent, even whether to provide free coffee to employees, the newly minted entrepreneur can only think of positive thoughts and great outcomes.

decisions about finding a company name, where to locate the company, whether to lease an office or start from home, how to engage talent, even whether to provide free coffee to employees, the newly minted entrepreneur can only think of positive thoughts and great outcomes. focus of my three entrepreneurial businesses as a prime driver in my life during the early stage of each. And yet, as I recall the greatest thrills, the memorable events, the best of memories, almost none are about the money.

focus of my three entrepreneurial businesses as a prime driver in my life during the early stage of each. And yet, as I recall the greatest thrills, the memorable events, the best of memories, almost none are about the money. once was, coaching them, putting them together with others who have needed skills, helping to build someone else’s dream. If you are in such a good place in your life, find a local angel investing group by navigating to

once was, coaching them, putting them together with others who have needed skills, helping to build someone else’s dream. If you are in such a good place in your life, find a local angel investing group by navigating to