I have saved this next story until now because it is one of my favorites, and certainly illustrates the point as well as anything I could devise from fiction.

First here is a bit of the background. The year was 1998. After presenting a “state of the company” report at a national meeting of resellers for a company where I sat on the board, I was approached by one of the audience members, complimenting my presentation and stating, “I have a problem. I’ve been offered $15 million for my company and my partner is suing me for all I am worth. What can I do?” I promised to come see him at his office the very next week. What I discovered was a contradiction that was too intriguing to ignore. The company of eight was engaged in web design, hot at the time. And yes, the partner had a valid suit, having been locked out of the business and denied access to decisions and accounting information.

But the real asset became obvious at almost exactly 5 PM that day, when all eight stopped what they were doing and began using a tool they had licensed from a Florida company to find other Internet gamers to join them in playing intense first party shooter games over the ‘net. The tool it turns out had been posted on the company’s website and downloaded by over a million gamers. Over a million of these came to the company’s game web site each month for new information and to form an early Internet game community. The company made little effort to charge for the software or community. Microsoft had just bought Hotmail for $9 per registered user; AOL had just bought ICQ for $40 per registered user. And here were over a million users, with no apparent value to the web designers, except as a community of friends with similar interests.

[email readers continue here…] Did I forget to tell you that on that day, looking into the company’s books, I discovered that neither the company nor its founder had filed Federal income tax returns during the three years in business? And there were other quite obvious problems, unattended to, along with the partner’s suit hanging over their heads.

I immediately agreed to come aboard at no cost to clean up the corporation, deferring my investment until that was done. I negotiated a settlement with the partner for $100 thousand which I paid, then filed all of the overdue tax returns of various types, and cleaned up the books. Offering to reincorporate the game company as a new entity to avoid any more surprises, we negotiated 10% for my $100 thousand, with the remaining 90% for the founder. In addition, I loaned the new company $150 thousand for working capital. By this time there were not one but four million registered users.

I immediately agreed to come aboard at no cost to clean up the corporation, deferring my investment until that was done. I negotiated a settlement with the partner for $100 thousand which I paid, then filed all of the overdue tax returns of various types, and cleaned up the books. Offering to reincorporate the game company as a new entity to avoid any more surprises, we negotiated 10% for my $100 thousand, with the remaining 90% for the founder. In addition, I loaned the new company $150 thousand for working capital. By this time there were not one but four million registered users.

Within three months, we easily obtained $3 million of investment at a pre-money valuation of $30 million. Can you begin to tell that this is a story of timing, and of the Internet bubble? Three months later, another investor company in the business offered to invest $3 million at a valuation of $60 million. Two months after that, a French game company offered $1.5 million at a valuation of $80 million. Of course we took all of these.

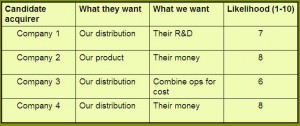

We now jump forward to February, 2000, 14 months after formation of the company. Another major competitor in the industry, directly competing with one of our investors, offered $140 million for 49% of the company in a combination of equal cash and stock in its public entity.

Fast forward a month to a meeting between a senior executive of the buyer, our hero the entrepreneur, our corporate attorney and myself. In planning for the transition about to take place, the executive stated to the entrepreneur, “You know, we are buying only 49% so that we do not have to roll your losses into our income statement; but we do expect to make the decisions as if a majority owner.” Our entrepreneur, engorged with the year’s effortless value increases, turned to the executive without a pause, and said something to the effect of “Hell no! We can make this company worth a billion without you!” And so, a mere month before the crash of the Internet bubble, the buyer withdrew the offer. And, even if some of us were more than unhappy, we went back to the work of building the company value. And a month later the bubble burst.

It took almost four years to sell the company for over $60 million, not at all a bad outcome for us founders and the early shareholders. And I do need to note that the entrepreneur in the meantime became a model executive of a growing company, much more mature and understanding of market forces than that fateful day in February, 2000.

Could I have found a better example of “Timing is everything”? The lesson: Look for cycles in your business and in the marketplace. There are natural high points in one or both that may not be obvious until looking back. But they occur often enough to watch for and take advantage of if ready to make the run for a liquidity event.