How important is this issue for your business?

The subject of raising money is critical to many businesses and a passing option to others, depending upon the capital efficiency of the enterprise. Some businesses require very little capital and the founder can self-finance the enterprise and retain 100% of its ownership and control from ignition through liquidity event (startup through sale). For those of you who fit that description, nice work.

When the need is high…

For the rest of us, desiring to build large, valuable enterprises quickly, the need for outside capital is high on our list of requirements and even the source for some sleepless nights as we worry over the availability and cost of capital. It is for this group that we explore the implications implicit in raising money for growth.

It might be useful to list some of the ways in which you can raise money for growth with and without outside investors.

Bootstrapping:

This term describes your ability to start a business with little investment and grow it using internally generated funds. Certainly, bootstrapping is a preferred method of funding growth if it does not hold back the speed of growth or hobble the quality of product or service to the extent that better-funded competitors can overtake the business. There is a lot to say about retaining control. You will realize much more from the ultimate sale of your business even if at a considerably lower price than if splitting the proceeds with investors. You will have more control over strategy and execution than with an outside board overseeing planning and performance. But few businesses grow into the sweet spot of $20 million to $30 million in worth to an ultimate buyer without the injection of outside capital.

Friends, family and fools:

[Email readers, continue here…] This term, although pejorative, describes the typical mix of early investors in a small, young growing business. Money from these sources is relatively easy to come by, and most often comes with no strings as to oversight by a formal board composed of these investors and management. However, most often, these funds are solicited by a well-meaning entrepreneur from investors who are not qualified as accredited investors under the law (currently requiring a proved income of $200,000 a year or $1 million in net worth for an individual investor).

My experience with early valuations by founders for friends…

I’ve arrived at a significant number of companies that were looking for additional growth capital after a “friends and family” round and had to “clean up” the cap table more than a few times over the years. Taking this kind of money has several pitfalls you should be aware of. It is most common to greatly overprice such a round of financing, valuing the enterprise well above what it may be worth at the moment for friends or related investors who do not have the sophistication or willingness to challenge the valuation.

I’ve arrived at a significant number of companies that were looking for additional growth capital after a “friends and family” round and had to “clean up” the cap table more than a few times over the years. Taking this kind of money has several pitfalls you should be aware of. It is most common to greatly overprice such a round of financing, valuing the enterprise well above what it may be worth at the moment for friends or related investors who do not have the sophistication or willingness to challenge the valuation.

The result of early over-valuation…

When professional investors look at such overvalued prior investments, they may refuse to become involved with a company, knowing that there will be, at the very least, universal disappointment and anger from prior investors when a new round is priced lower than the earlier friends and family round. Sometimes this money is just too available, and the risks seem so far away; so, an entrepreneur will take the money and put off the worry over the eventual consequences, all in the hope that no more investment will ever be needed and everyone will be richer for the effort.

Using your bank credit line and credit cards:

Even with the credit crunch signaled by the recent threat of recession, many banks will issue business credit cards with a $50,000 limit if the entrepreneur is willing to personally guarantee the balance, and has the net worth to do so. And even with the significant cost of credit card debt, many entrepreneurs aggressively use existing cards to finance a startup. It’s an option, even though an expensive one.

“Strategic partner” investors:

If you can find a strategic partner willing to invest in your enterprise, consider it a blessing. Whether the partner is a supplier looking to gain a lock on your business as it grows or a customer looking to create a competitive barrier through use of your product, such an investment typically carries fewer restrictions than from a professional investor and less oversight. Better yet, the valuation of your enterprise is often higher than if the same investment were taken from a professional investor. Strategic investors validate a business, by their presence creating the very value they pay for with increased price per share purchased. It is most often a win-win for both you and the strategic partner.

Professional angels:

This is the arena where I work and play. This class of investor, once quite disorganized, has become much like the venture capital community, creating a process including due diligence (careful examination of a business before investment), terms of investment that match those of venture capitalists, and a process that sometimes takes months from introduction to investment. Yet, professional angels are usually willing to take active board seats in a young enterprise and act as cost-free consultants to the CEO-entrepreneur, giving freely of their individual and collective years of experience, often in the same industry as the investment target.

Do not expect grand valuations of your enterprise from these professional angels. They have been burned too badly during the last decade by overvaluing businesses and finding themselves like friends and family, “stuffed” into a down round of lower valuation when a company takes its next round of financing from the next step, venture capitalists. Professional angels, often organized into groups, usually invest from $100,000 to $1 million in a young enterprise.

Accelerators:

This relatively recent combination of coach and limited investor is available to some early-stage businesses, usually in major cities, and requires that the entrepreneurs spend from weeks to months being coached by the accelerator team. In return, the accelerator often invests $25,000 to $100,000 in the young enterprise and takes from five to ten percent of the equity in return. At the conclusion of the acceleration period, the company participates in a “demo day” in which institutional investors are invited to review the company in a live pitch session. Many accelerators have come and gone during these past five years. Several are well-known and professional investors pay special attention to their graduates. These include Y-Combinator and TechStars, among others.

Venture, private equity and more:

Here we lump a large number of investor classes into one. Venture capital comes with a cost, and there are no bargains for the company when taking such an investment. VC’s value an enterprise lower than others might at the same stage of investment, always aware of the need to create opportunities for “home run” profits at exit, since over fifty percent of their investments typically are lost when companies die before an opportunity to sell to others. Further, as a class, VC’s have not done well for their own investors over the past decade except for several first-tier entities, making it doubly important to fight for low valuations and high profits at exit.

VC’s do not even engage in discussion with most of those entrepreneurs seeking capital. By some estimates, 95% of contacts are ignored unless they come as referrals from trusted sources such as known lawyers, accountants, or fellow VC’s. And just for measure, VC’s fund less than 2% of all deals they do investigate. Typical VC investments begin at $2 million and quickly rise to $5 million and above, depending upon the size of the fund and stage of investment. Terms are much more restrictive than from strategic or angel investors, often requiring the entrepreneur to escrow his or her founder stock for a number of years to prevent the founder leaving, and restricting the sale of prior stock without the VC also being allowed to offer a share of its holdings in the same sale.

VC’s do not even engage in discussion with most of those entrepreneurs seeking capital. By some estimates, 95% of contacts are ignored unless they come as referrals from trusted sources such as known lawyers, accountants, or fellow VC’s. And just for measure, VC’s fund less than 2% of all deals they do investigate. Typical VC investments begin at $2 million and quickly rise to $5 million and above, depending upon the size of the fund and stage of investment. Terms are much more restrictive than from strategic or angel investors, often requiring the entrepreneur to escrow his or her founder stock for a number of years to prevent the founder leaving, and restricting the sale of prior stock without the VC also being allowed to offer a share of its holdings in the same sale.

Micro-VC’s:

This is a recent class of venture investors, often with smaller funds, and willing to invest from $1,000,000 to $2,000,000 on average, filling a gap between professional angels and VC’s.

Private equity investments are available from firms created for this later stage opportunity, but typically are available only for businesses that have achieved revenues well above $50 million. Often private equity investors will want control of the business as well.

Bank lines of credit are often available to businesses that are profitable, most often personally guaranteed by the entrepreneur, but available at a cost in interest less than most any other source. Small Business Administration (SBA) federally guaranteed bank loans are available again after years of limited activity. With some restrictive provisions, these loans are favored by many banks as carrying much less risk than loans without the guarantee.

But it is the outside investor that validates a business, often influencing growth with shared relationships, experienced guidance and providing a gateway to needed resources. In the next weeks, we will investigate several insights that relate to these money resources, all to help you to determine what is right for you, and how to prepare and succeed in securing funds.

that I could neither compensate for lags behind the leader nor test my comfort zone at various points that matched the expectation of my instructor and my own increasing capabilities as a driver. Upon conclusion of eight laps of this, after pulling into the alley and climbing through the window on the driver side (there are no doors in these cars), I was handed a sheet with my timings for each of the eight laps. Only then, after when the information might have been useful, could I see how well I did.

that I could neither compensate for lags behind the leader nor test my comfort zone at various points that matched the expectation of my instructor and my own increasing capabilities as a driver. Upon conclusion of eight laps of this, after pulling into the alley and climbing through the window on the driver side (there are no doors in these cars), I was handed a sheet with my timings for each of the eight laps. Only then, after when the information might have been useful, could I see how well I did. You can think of numerous critical measures for your business that must not be ignored, but often are neglected by senior management. It is not bad to manage by walking around, a term that came from another of the many business advice books of the ‘90’s. But that method, although good for employee morale, is imprecise as a tool of measurement and should be relegated to a supporting role for you. Financial information from last month compared to plan and same month last year is certainly relevant, but not part of a dashboard, since there is nothing you can do to fix a problem when numbers are as old as a week, let alone the typical several weeks required to prepare financial statements for review.

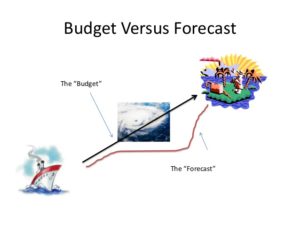

You can think of numerous critical measures for your business that must not be ignored, but often are neglected by senior management. It is not bad to manage by walking around, a term that came from another of the many business advice books of the ‘90’s. But that method, although good for employee morale, is imprecise as a tool of measurement and should be relegated to a supporting role for you. Financial information from last month compared to plan and same month last year is certainly relevant, but not part of a dashboard, since there is nothing you can do to fix a problem when numbers are as old as a week, let alone the typical several weeks required to prepare financial statements for review. upon constant changes and call it a forecast? So, let’s spend a few moments defining this sometimes-confusing set of terms.

upon constant changes and call it a forecast? So, let’s spend a few moments defining this sometimes-confusing set of terms. Note that I used the term “forecast” for revenues for the next year. The term is also used when projecting revenues for succeeding years.

Note that I used the term “forecast” for revenues for the next year. The term is also used when projecting revenues for succeeding years. measurable as steps toward achievement of your goal. Today, we explore how to create tactics to accompany each strategy, and even suggest a number of tactics to consider for your strategies.

measurable as steps toward achievement of your goal. Today, we explore how to create tactics to accompany each strategy, and even suggest a number of tactics to consider for your strategies. Note that each of these tactics directly support the strategy, are measurable and assumed to be achievable, bought into by each department affected by the tactic. Note that the strategy calls for cooperation between business development, sales, marketing, product development, installation, and support. This is a great way to unify departments that once may have competed for resources toward individual ends, now pointed toward a common goal supported by all levels of management up to the CEO.

Note that each of these tactics directly support the strategy, are measurable and assumed to be achievable, bought into by each department affected by the tactic. Note that the strategy calls for cooperation between business development, sales, marketing, product development, installation, and support. This is a great way to unify departments that once may have competed for resources toward individual ends, now pointed toward a common goal supported by all levels of management up to the CEO.

So, if you have not, create a concise map for your enterprise. Start with a reasonable goal, usually expressed as a revenue number some number of years into the near future. Assess your current resources and attempt to calculate the resources needed to accomplish the goal.

So, if you have not, create a concise map for your enterprise. Start with a reasonable goal, usually expressed as a revenue number some number of years into the near future. Assess your current resources and attempt to calculate the resources needed to accomplish the goal. the size of your market niche, and whether you can overcome the many barriers to access customers within your niche.

the size of your market niche, and whether you can overcome the many barriers to access customers within your niche. some degree of your potential growth. What can you prove as a barrier to entry for competitors? Is it the advantage of time – years of development ahead of any competitor? A core patent or “thicket” of patents protecting your offering? A strategic relationship with one or more of the largest customers?

some degree of your potential growth. What can you prove as a barrier to entry for competitors? Is it the advantage of time – years of development ahead of any competitor? A core patent or “thicket” of patents protecting your offering? A strategic relationship with one or more of the largest customers? services businesses that make fine lifestyle opportunities for architects, doctors and dentists. But these types of businesses are not attractive to potential buyers willing to pay a premium for businesses that are worth millions more than their asset value. Building a great business to create wealth for the entrepreneur at exit, means thinking of the exit strategies from the beginning. Who or what type of buyer would be attracted to this business if successful? Great wealth is made from selling great businesses at immense profit for the entrepreneurs and investors who took the journey.

services businesses that make fine lifestyle opportunities for architects, doctors and dentists. But these types of businesses are not attractive to potential buyers willing to pay a premium for businesses that are worth millions more than their asset value. Building a great business to create wealth for the entrepreneur at exit, means thinking of the exit strategies from the beginning. Who or what type of buyer would be attracted to this business if successful? Great wealth is made from selling great businesses at immense profit for the entrepreneurs and investors who took the journey. change the world for the better.

change the world for the better. The good thing about a goal is that it is measurable, and progress toward it can be measured as well. Unlike your vision, which can’t be measured, there is a satisfaction in each step toward achievement of your goal. For business goals, your employees and investors will appreciate constant attention to the goal and reports of progress toward it. A goal serves as a rallying point for all associated with your vision.

The good thing about a goal is that it is measurable, and progress toward it can be measured as well. Unlike your vision, which can’t be measured, there is a satisfaction in each step toward achievement of your goal. For business goals, your employees and investors will appreciate constant attention to the goal and reports of progress toward it. A goal serves as a rallying point for all associated with your vision. whose creativity and intelligence are admired by many. But he dilutes his effectiveness with wordy PowerPoint presentations. It has become a long running joke between us, as I often remind him that most of us have a very limited attention span and ability to recall important points from a presentation.

whose creativity and intelligence are admired by many. But he dilutes his effectiveness with wordy PowerPoint presentations. It has become a long running joke between us, as I often remind him that most of us have a very limited attention span and ability to recall important points from a presentation. visionaries who see a new marketplace or niche or how to reach the mass market in ways not previously attempted.

visionaries who see a new marketplace or niche or how to reach the mass market in ways not previously attempted. Leonard Kleinrock and a few of his UCLA computer lab students worked to send the first several text characters from UCLA to Stanford in 1969 over a direct line established for the test. They could send only the “LO” of “LOGON” before recording the very first crash of what was to become the Internet. And I’m sure they had no idea what they were fathering with that effort which eventually became ARPANET, and then of course, the Internet itself. They had no mantra, and a limited vision to connect mainframe computers to share academic information.

Leonard Kleinrock and a few of his UCLA computer lab students worked to send the first several text characters from UCLA to Stanford in 1969 over a direct line established for the test. They could send only the “LO” of “LOGON” before recording the very first crash of what was to become the Internet. And I’m sure they had no idea what they were fathering with that effort which eventually became ARPANET, and then of course, the Internet itself. They had no mantra, and a limited vision to connect mainframe computers to share academic information. artificial general intelligence (AGI). Yet, so far, we have the foundation, thanks to development teams at OpenAI, Google and Microsoft among others. It won’t be long before we hear names of innovators who invent new uses for AI forming highly profitable companies around the work of inventors who laid the groundwork for these yet to come applications.

artificial general intelligence (AGI). Yet, so far, we have the foundation, thanks to development teams at OpenAI, Google and Microsoft among others. It won’t be long before we hear names of innovators who invent new uses for AI forming highly profitable companies around the work of inventors who laid the groundwork for these yet to come applications.